İyi bir dijital pazarlama ajansında çalışan bir ads uzmanı olarak, Google Ads hizmetinin birçok işletme için web trafiğini artırmada başvurulabilecek en güçlü araçlardan biri olduğunu söyleyebilirim. Reklam vermeyi düşünen müşterilerimizin en sık sorduğu sorulardan biri “Google Ads veya Meta Ads’e yapılan harcamalar vergiden düşülebilir mi?” sorusudur. Bu sorunun cevabı kısaca evettir. Ancak, giderlerinizi vergiden düşürmeden önce Google Ads ve Meta reklamları için dikkat etmeniz gereken bazı ayarlar hakkında konuşacağım. Daha sonra mali müşavirinize göndereceğiniz faturalarınıza vergi numaranızı nasıl ekleyeceğinizi ve bu faturalara nereden ulaşacağınızı adım adım anlatacağım.

Google Ads ve Meta Reklam Giderleri Nedir?

Google Ads, işletmelerin ürün ve hizmetlerinin reklamlarını Google arama sonuçlarında ve Google’ın arama ağı partnerlerinde göstermelerini sağlayan bir reklam platformudur. Reklamlarda seçilen CPC, CPA ve CPM gibi teklif stratejilerine göre harcamalar yaparak giderler oluşur.

Meta reklamları ise Facebook ve Instagram platformlarında yayınlanan reklamları, oluşturmanızı ve yayınlamanızı sağlayan bir platformdur. Meta reklamlarında da harcamalar, aynı Google Ads’de olduğu gibi, CPC, CPA ve CPM gibi teklif stratejilerine göre gerçekleşir. Bu stratejiler, reklam maliyetlerini belirler ve harcamalar bu stratejilere göre belirlenir.

Google Ads Faturalandırma Kurulumu

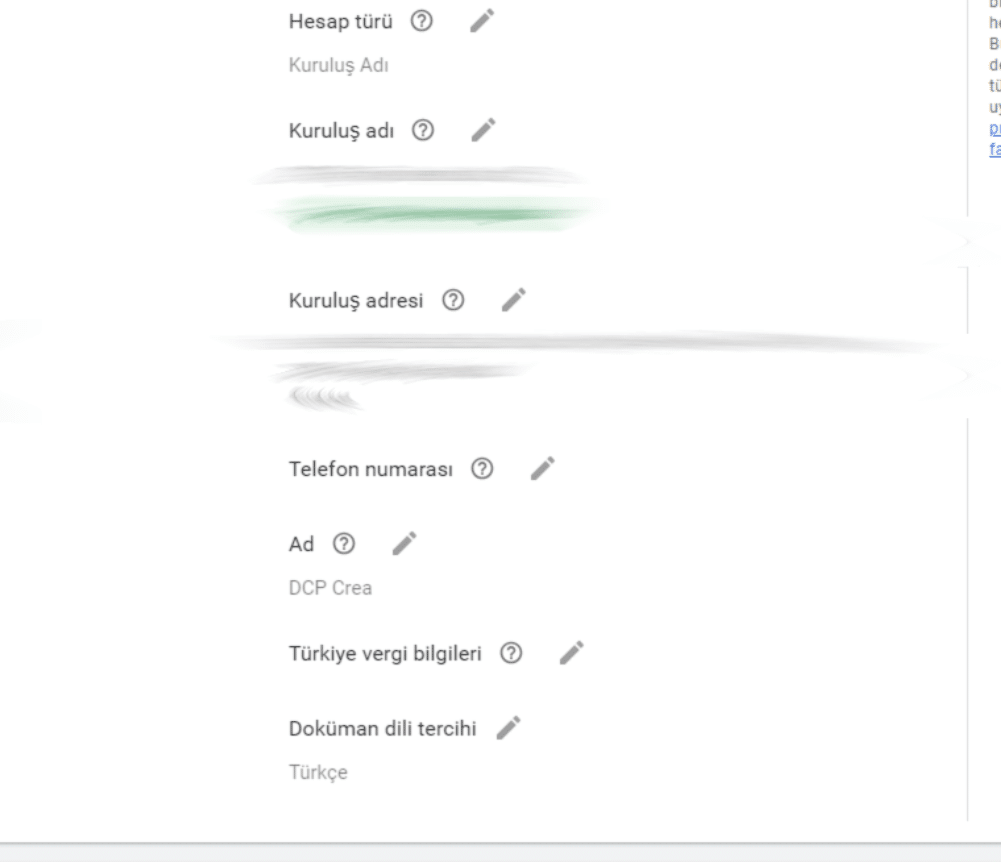

Google Ads harcamalarınızı gider olarak gösterebilmek için, Google ADS faturalarınızda vergi numaranızın yazması gerekir. Bunun için ise Google Ads platformunda bazı ayarlamalar yapmanız gerekli. Aşağıda bu ayarlamaları nasıl yapacağınızı anlattım.

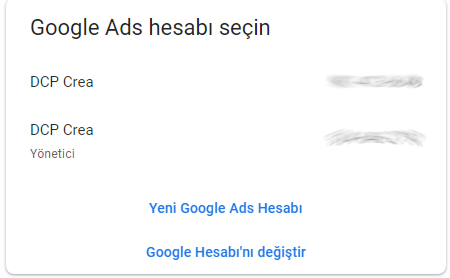

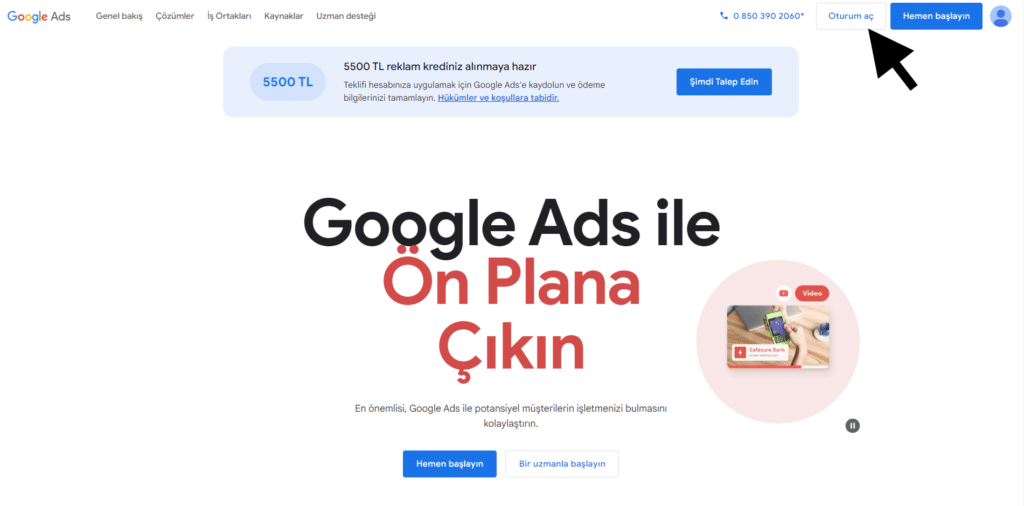

- Google Ads hesabınıza giriş yapın.

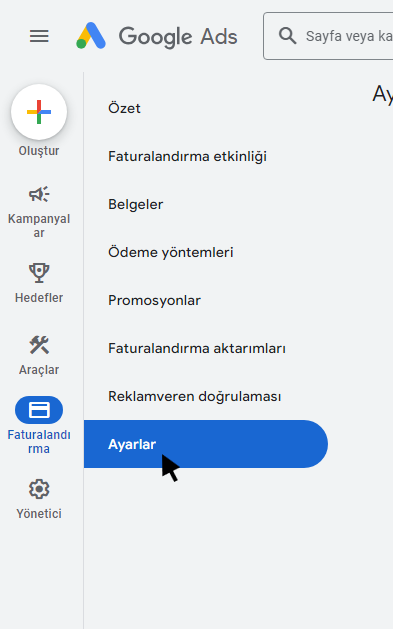

- Sol taraftaki sütunda “Faturalandırma” başlığının altında bulunan “Ayarlar” bölümüne tıklayın.

- Açılan sayfada “Ödeyen ayrıntılar” sekmesine tıklayın ve “Türkiye vergi bilgileri” yazan bölümün yanındaki kalem sembolüne tıklayın.

- Açılan sayfadaki formu doldurun ve vergi numaranızı girdiğinizden emin olun.

Bu adımları tamamladıktan sonra ekstrelerinizde vergi numaranız yer alacaktır. Bu işlem, mali müşavirinizin faturalarınızı sorunsuz bir şekilde gider olarak gösterebilmelerini sağlar.

Meta Reklamları İçin Faturalandırma Kurulumu

Yine aynı şekilde Meta reklamları için de vergi numaranızı kaydetmeniz bir zorunluluktur. Bir önceki bölümde Google Ads’e vergi numaranızı nasıl ekleyeceğinizi göstermiştim. Benzer adımlarla Meta Business Suite üzerinden, Meta reklamlarının harcamaları için de bir vergi numarası ekleme işlemi yapmanız gerekmektedir..

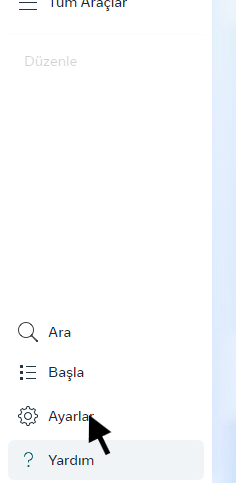

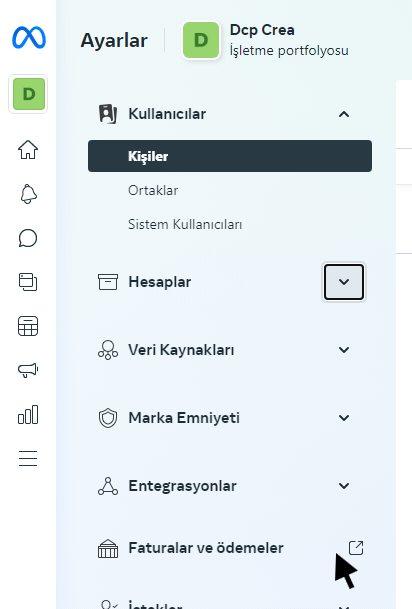

- Meta Business Suite’e giriş yapın ve sol taraftaki sütunda “Ayarlar” ikonuna tıklayın.

- “Faturalar & Ödemeler” sekmesine tıklayın.

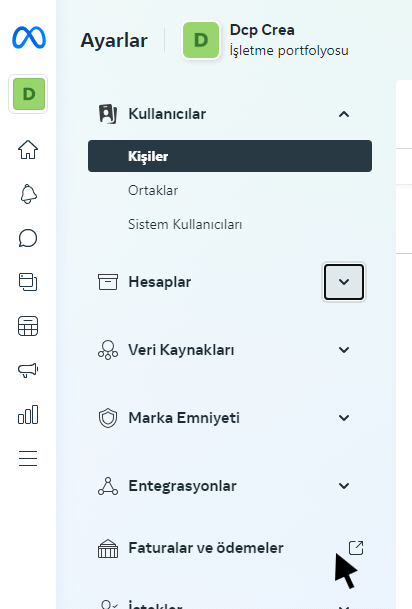

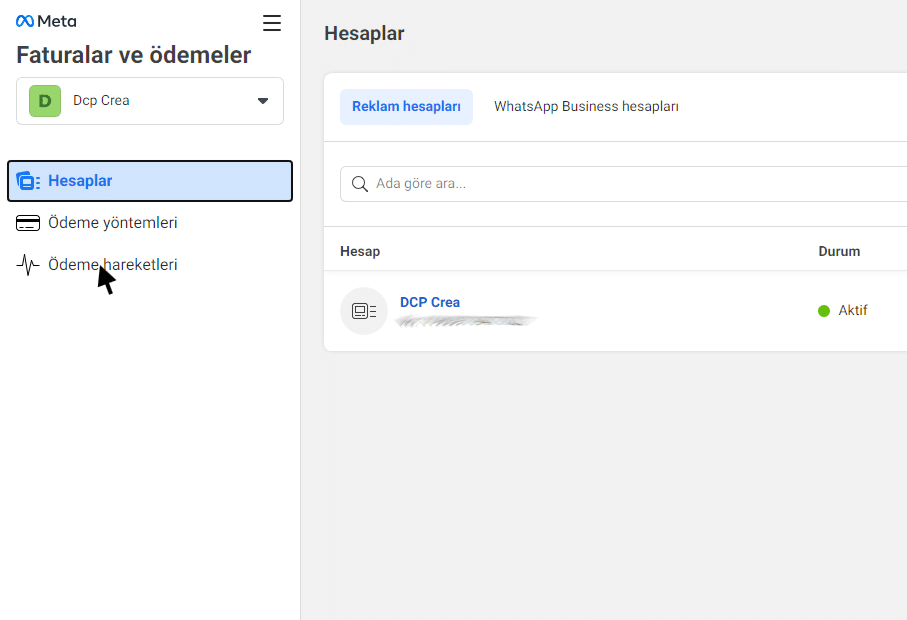

- Karşınıza “Hesaplar” sayfası çıkacaktır. Bu sayfada, hesabınızın sağ tarafında bulunan “Ödeme yöntemi ekle” butonunun yanındaki üç nokta sembolüne tıklayın. Ardından “Detayları gör” butonuna tıklayın.

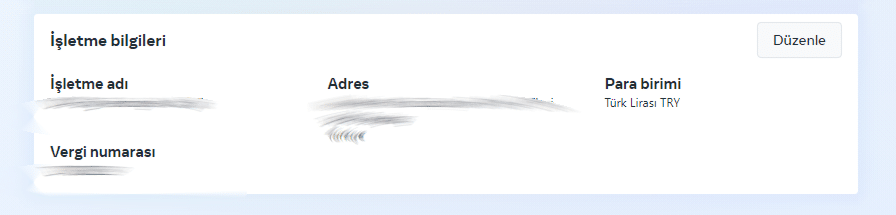

- “İşletme Bilgileri” sekmesinin sağ üst tarafındaki “Düzenle” butonuna tıklayın ve “İşletme Bilgileri” formunu doldurun. Bu kısımda “KDV numarası” olarak geçen vergi numaranızı da ekleyin.

Böylece Meta reklamları ekstrelerinizde vergi numaranız gözüküyor olacak. Dikkat etmeniz gereken şey ekstrelerinizdeki bilgiler şirketinizin bilgileriyle eşleşmek zorundadır. Eğer ekstrelerinizdeki bilgiler şirketinizin vergi numarasıyla, adresiyle uyuşmuyorsa, ekstrenizin mali müşaviriniz tarafından gider gösterilmesinde sorunlar çıkabilir.

Google Reklam Giderleri Ekstrenizi Nasıl Alabilirsiniz?

Google Ads kurulumunu yaptınız ve reklamınızın ekstresini almanın günü geldi. Artık ekstrenizi almak, bunu mali müşavirinize iletmek veya ekstrelerinizi kaydetmek istiyorsunuz. Neyse ki Google bunu bizim için çok kolaylaştırdı. Aşağıda Google ADS platformunda nasıl ekstre alacağınızı adım adım bulabilirsiniz.

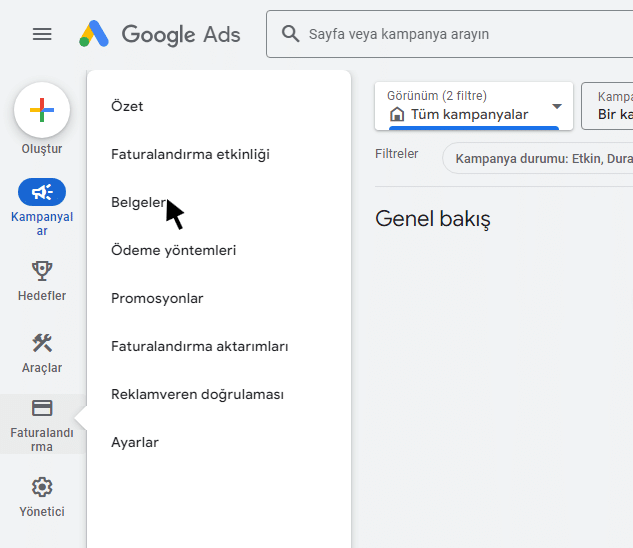

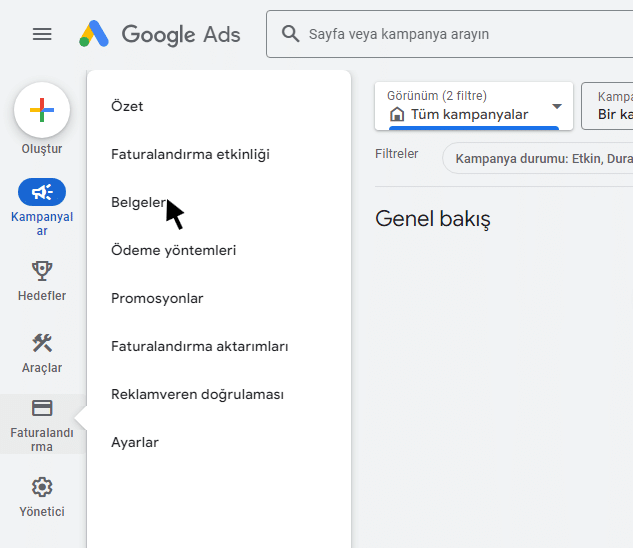

- Google Ads platformuna giriş yapıyoruz ve soldaki sütunun üzerine gelip “Belgeler” bölümüne tıklayın.

- Karşınıza çıkan ekranda hesap ekstrelerinizi görebilirsiniz.

Yukarıdaki adımları uyguladıktan sonra mali müşavirinize göndermek üzere ekstrenizi indirebilir, inceleyebilir veya kaydedebilirsiniz.

Meta Reklam Giderleri Ekstrenizi Nasıl Alabilirsiniz?

Google Ads’e benzer şekilde Meta reklamlarında da ekstrenizi almak için sadece birkaç tıklama yetiyor. Ekstrenizi incelemek, indirmek veya başka işlemler için aşağıdaki adımları takip edin.

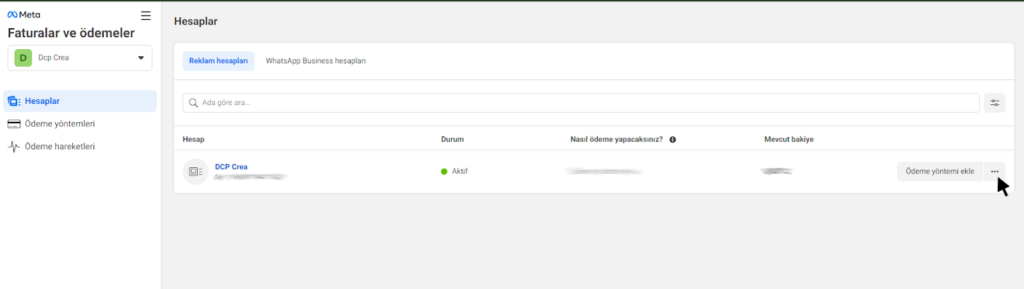

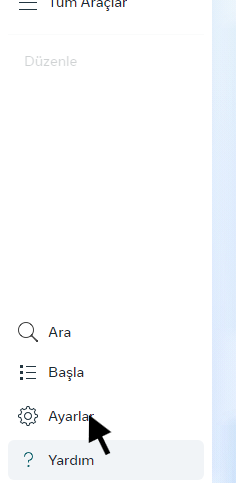

- Meta Business Suite hesabınıza giriş yapın ve soldaki sütundan ayarlar ikonuna tıklayınız.

- Daha sonra gelen ekranda yine soldaki sütundan “Faturalar ve Ödemeler” sekmesine giriniz.

- En son olarak soldaki sütundan “Ödeme Hareketleri” sekmesine girin. Açılan sayfada ekstrelerinizi görüntüleyebilirsiniz.

Yukarıdaki adımları uyguladıktan sonra ekstreleriniz ile yapacağınız her işlemi rahatça gerçekleştirebilirsiniz.

Google Ads ve Meta Reklam Giderleri Nasıl Vergiden Düşürülür?

Google Ads ve Meta reklam giderleri, Türkiye’de vergiye tabi olmayan yurtdışı şirketlerden alınan hizmetler olarak değerlendirilir. Bu nedenle, bu giderlerin vergiden düşürülebilmesi için belirli işlemler yapılmalıdır:

- Google Ads Ekstresi: Google Ads üzerinden yaptığınız harcamalar karşılığında doğrudan bir fatura alamazsınız. Google, KDV dahil/hariç bir fatura sunmaz. Bunun yerine, Google Ads panelinden harcamalarınıza dair bir ekstre alabilirsiniz. Bu ekstre, KDV oranı 0 olarak gösterilen ve “Bu Bir Fatura Değildir” ibaresi içeren bir belgedir. Bu ekstre ile ödemelerinizi muhasebe biriminize ileterek KDV2 beyannamesi düzenletebilir ve vergi yükümlülüklerinizi yerine getirebilirsiniz. Ayrıca %15 stopaj ödemesi de yapılması gerekmektedir.

- Meta Reklamları: Meta (Facebook ve Instagram) reklamları için de durum benzerdir. Meta Business Suite üzerinden reklam harcamalarınıza dair faturalarınızı görüntüleyebilir ve indirebilirsiniz. Ancak, Google Ads’te olduğu gibi burada da doğrudan bir fatura değil, harcamalarınıza dair bir ekstre alırsınız.

Vergi Yüzdeleri

- Katma Değer Vergisi (KDV): %20

- 3000 TL harcama yaparsanız, 3000 TL x 0,20 = 600 TL KDV ödemeniz gerekir. Ancak, tevkifat uygulanarak bu KDV’nin 7/10’u ödenir ve 3/10’u geri alınır. Örneğin, 600 TL KDV tutarı için tevkifat uygulanarak ödemeniz gereken KDV: 600 TL x 7/10 = 420 TL olacaktır.

- Stopaj Vergisi: %15

- Yine, 3000 TL harcama yapıyorsanız, stopaj vergisi (3000 TL / 0,85) x 0,15 = 529 TL olacaktır.

- Dijital Hizmet Vergisi (DHV): %7.5

- 3000 TL’lik bir harcamada, Dijital Hizmet Vergisi 3000 TL x 0,075 = 225 TL olacaktır.

- Düzenleyici Operasyon Maliyeti: %7

- 3000 TL’lik bir harcama için 3000 TL x 0,07 = 210 TL Düzenleyici Operasyon Maliyeti tutarı çıkacaktır.

KDV2 beyannamesi düzenlendiğinde, yukarıda belirtilen vergiler (KDV, Stopaj, Dijital Hizmet Vergisi ve Düzenleyici Operasyon Maliyeti) beyannamede otomatik olarak yer alacaktır. Bu nedenle, vergi yükümlülüklerinizi yerine getirirken bu vergileri ayrıca hesaplamanıza gerek kalmayacaktır.

Reklam Faturaları Üzerine Son Sözler

Google Ads ve Meta reklam giderleri, birçok işletme için gider olarak gösterilebilecek yüklü tutarlar bulundurabilir. Bu tutarları vergiden düşerek Google Ads ve Meta harcamalarından maksimum fayda sağlayabiliriz. Bu giderlerin verginizden düşürülmesi, işletmenizin vergi yükünün azalmasını sağlar. Ekstrenizde vergi numaranızı, adresinizi ve şirket isminizi doğru bir şekilde belirtmek, sürekli güncel tutmak giderlerinizi vergi olarak göstermek için olmazsa olmazdır. Mali müşavirinizle iş birliği içinde olmak dijital pazarlama sektörüne ayırdığınız bütçenizden maksimum verimi almanızı sağlar.